Taxpayers should rely on a skilled advisor and tax manager who can help identify a strategy that best aligns with their goals and results in the most compelling after-tax returns. At Bernstein we’re careful to integrate tax considerations in our portfolio management for all taxable clients.

As long as an investment remains attractive, we normally recommend deferring gains for as long as possible to compound tax savings within your portfolio. That said, there is always a trade-off between the risk of being stuck in a suboptimal investment and the benefit of tax deferral. But you may need to revisit that calculation if taxes are poised to rise. In that case, you must weigh the potential advantages of tax deferral against the cost of paying taxes at a potentially higher rate down the road.

The US presidential election in November could usher in higher taxes as soon as 2021. Tax ideas floated by Democratic presidential nominee Joe Biden include raising the top marginal long-term capital gains rate from 23.8% to 43.4% (inclusive of the 3.8% Medicare surcharge)—an 82% increase. If this comes to pass, many investors will benefit from realizing capital gains at a lower tax rate before the hike takes effect. That means tax-sensitive investors may have to do something they likely never considered: accelerate the recognition of taxable gains.

The Benefits of Taking Gains Now

Consider the following example showing the benefits of taking gains today. Suppose you hold stock ABC with zero basis trading at $100. Let’s assume that ABC returns 10% over the next year and that the top marginal capital gains rate will increase from 23.8% to 43.4%. If you take the gain now, pay the tax, and reinvest the proceeds in stock DEF,1 you’ll owe $23.80 in taxes while owning $76.20 of DEF. If DEF subsequently returns 10%, you will have $83.82 in one year’s time. After taxing at 43.4% your net proceeds will be $80.51 (Display).

On the other hand, if you defer the gain, that $23.80 of ABC will remain in your portfolio and appreciate by 10% next year. Your pretax value will be $110, but it consists entirely of gains—which will be taxed at next year’s higher rate of 43.4%. Your after-tax proceeds will be $62.26. Ultimately, deferring recognition of the initial gain will cost you $18.25. In other words, you would have been better off taking the gain earlier!

The Factors That Matter

In deciding whether to reallocate your portfolio today by taking gains at potentially lower tax rates, expected returns and intended holding period matter—but (perhaps counterintuitively) not the size of the current unrealized gain.2

Let’s start with expected returns. How much return would you need for the benefit of compounding to offset the additional tax cost from selling in a world of higher capital gains taxes?

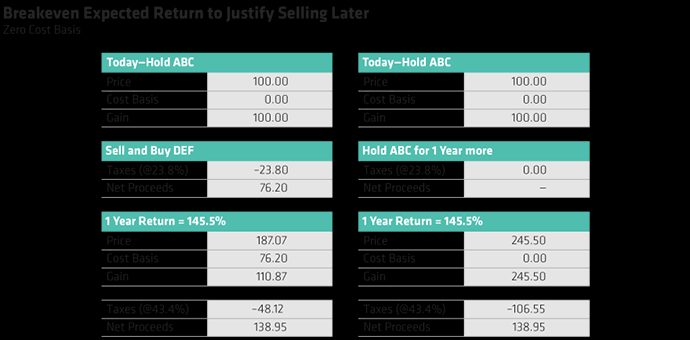

In this example we compare after-tax proceeds from selling today and reinvesting elsewhere for a year to simply holding the current investment for the same period. In both cases, the one-year return remains the same and the investment is liquidated at the end of the one-year horizon. We saw above that a 10% return fails to compensate for the higher capital gains tax rate. The challenge is to find the minimum one-year return that delivers the same after-tax wealth for the investor who holds on (then sells into a higher capital gains tax environment) and the one who liquidates at the lower capital gains tax rate, realizing a much smaller gain down the road (Display).

If you sell stock ABC today, you pay taxes of $23.80 and have $76.20 to reinvest. If the new investment—stock DEF—returns 145.5% (!) you will have $187.07 at the end of Year 2. After paying taxes when you liquidate, you end up with net proceeds of $138.95.

On the other hand, if you hold ABC for another year and then sell, the gain will be taxed at the higher rate of 43.4%. The after-tax proceeds will only match those from selling now and again in a year if stock ABC also returns 145.5%—a pretty unrealistic expectation. For anything less, the strategy of selling now and then again in a year generates more after-tax wealth.

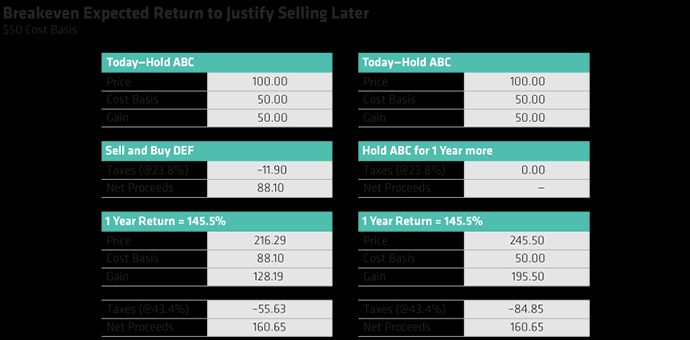

The example above assumes that ABC has a zero cost basis. What happens if we increase the cost basis to $50 (thereby reducing the size of the unrealized gain)?

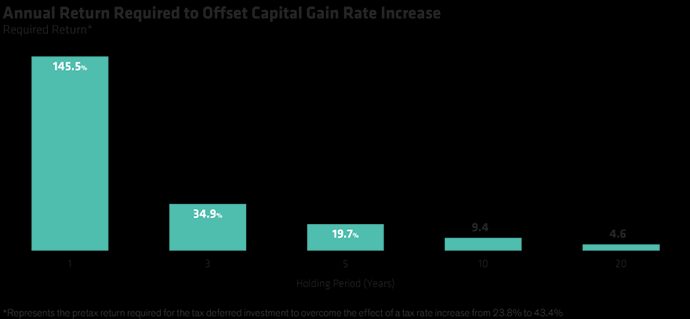

As the display shows, the magnitude of the gain does not impact the breakeven return requirement. But what if you hold the stock for a longer period? The chart below shows the return required for a given holding period.

As illustrated, if you keep the stock for 10 years, you’ll need a 9.4% annual return to offset the tax increase. So, in deciding whether to accelerate the recognition of gains, you need to consider your return assumptions and holding period. If, in fact, investors’ effective tax rate will increase from 23.8% to 43.4%, those with expected holding periods of less than 10 years should bring forward capital gains today to take advantage of the current, more favorable tax rates.

Concentrated Positions: A Double Benefit

Investors with concentrated positions could achieve a twofold benefit from selling now rather than later. In the examples highlighted above, we assume that you sell one stock (or investment) to harvest the embedded gain now, pay tax at the current (lower) rate, and then immediately purchase another stock (or investment). But what if the transaction you’ve been contemplating involves more than just repositioning your portfolio—what if it means fundamentally changing your risk profile by reducing the size of a concentrated holding?

This could be an especially good time to sell and diversify, ahead of potential tax rate increases. If capital gains rates rise, you’d pay less tax this year than next, and you’d also reduce the risk in your portfolio by diversifying out of a concentrated position. Investors who have wanted to diversify but have held off due to the tax cost may benefit from considering this strategy now.

Estate Planning Considerations

Potential tax changes could also impact estate planning decisions. In the preceding examples, we assumed that current gains would be realized in the future. What if you don’t plan on withdrawing money during your lifetime and instead plan to gift all or a portion of your taxable portfolio?

Many investors choose to pass appreciated holdings to the next generation. Holdings includable in one’s estate have typically enjoyed the benefit of a cost basis “step-up,” effectively erasing the gain and corresponding tax liability. When capital gains can be avoided (as with a step-up), deferring capital gains can maximize long-term family wealth no matter what the capital gains tax rate is. The ideas put forth by Biden, however, include eliminating the step-up in cost basis with inherited assets, so it’s possible this may no longer be an option.

With the uncertainty surrounding the future of the step-up and the potential for higher future capital gains taxes, realizing gains today to reposition your portfolio may prove considerably more compelling.

Make an Informed Decision

At this point, the tax changes outlined are just proposals, and investors have time to consider portfolio shifts that may enhance their tax situation pending changes in legislation. For most investors, it will not make sense to accelerate certain costs (such as capital gains today) for an uncertain benefit (such as potentially lower taxes later)—especially when the chance to act upon more concrete information may emerge down the road.

On the other hand, the proposed legislation may incentivize some investors to implement changes where they may have held off otherwise due to the associated tax costs. Investors should start having discussions today about the allocation they would implement if they were starting from scratch (free of any tax burden). This will ensure they have a plan in place to make an informed decision before such changes become really expensive.

- Paul Roberston

- Senior National Director, Tax & Transition Strategies—Investment Strategies Group

- John McLaughlin

- Portfolio Manager—Tax-Managed Strategies and Transitions

1Economic Substance Doctrine

A quick note of caution: There is a risk that a gains harvesting transaction that is entirely motivated by a desire to lower future taxes might ultimately be challenged by the IRS. Under the economic substance doctrine, a transaction must have a substantial purpose beyond simply reducing a tax liability. Without this “substantial purpose,” the IRS may determine that a strategy to reduce your taxes should be considered “abusive.” The IRS has the right to impose a 20% penalty on any underpayment of tax due to a transaction that lacks economic substance (and 40% if the transaction was not adequately disclosed on the taxpayer’s tax return).

With this in mind, we suggest that investors think about gains harvesting in the context of portfolio repositioning rather than simply increasing the basis of existing positions.

2This assumes your replacement investment will have the same return as your current investment. For sales of illiquid investments (e.g., a closely held business) this may not be reasonable and cost basis may be an important factor.

Notes:

The premise of this analysis is that capital gains rates rise next year. If rates were to stay at their current levels, selling early would likely lead to giving up the benefit of deferral without any tax savings in return. The risk of this outcome should be weighed before implementing this strategy.

This analysis does not reflect the impact of income generated over the holding period. To the extent that the investments generate income, the required return to breakeven would be lower.

As proposed, this would only apply, to this degree, to top marginal taxpayers with AGI greater than $1 million.